Overview

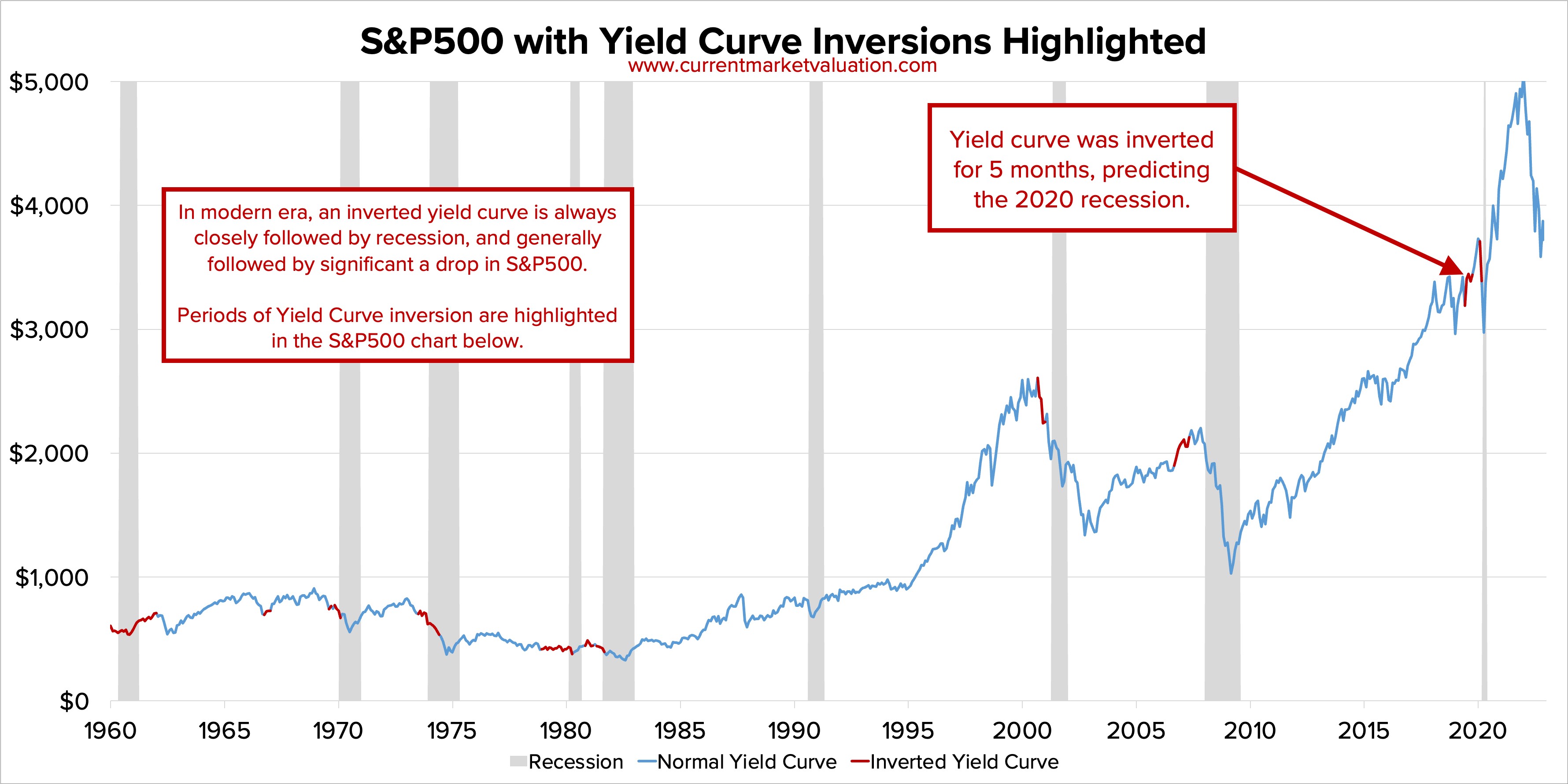

As of this writing the Yield Curve looks just about ready to invert, which combined with lots of other evidence suggests that the US may be heading towards a recession in the coming year. The data presented below suggests and illustrates that stock markets will likely underperform in the coming year or so. However the pattern is not consistent, especially recently, and trying to time the market is always a great way to lose money.

Defining a Recession

For awful political reasons, much hay has been made this past year about what is or isn't a recession. The classical rule-of-thumb has been that a recession is any two quarters of sequential GDP contraction. However, the official call is determined by the National Bureau of Economic Research (NBER) and does not follow any fixed statistical rule. From their FAQ:

NBER's traditional definition of a recession is that it is a significant decline in economic activity that is spread across the economy and that lasts more than a few months. The committee's view is that while each of the three criteria—depth, diffusion, and duration—needs to be met individually to some degree, extreme conditions revealed by one criterion may partially offset weaker indications from another.

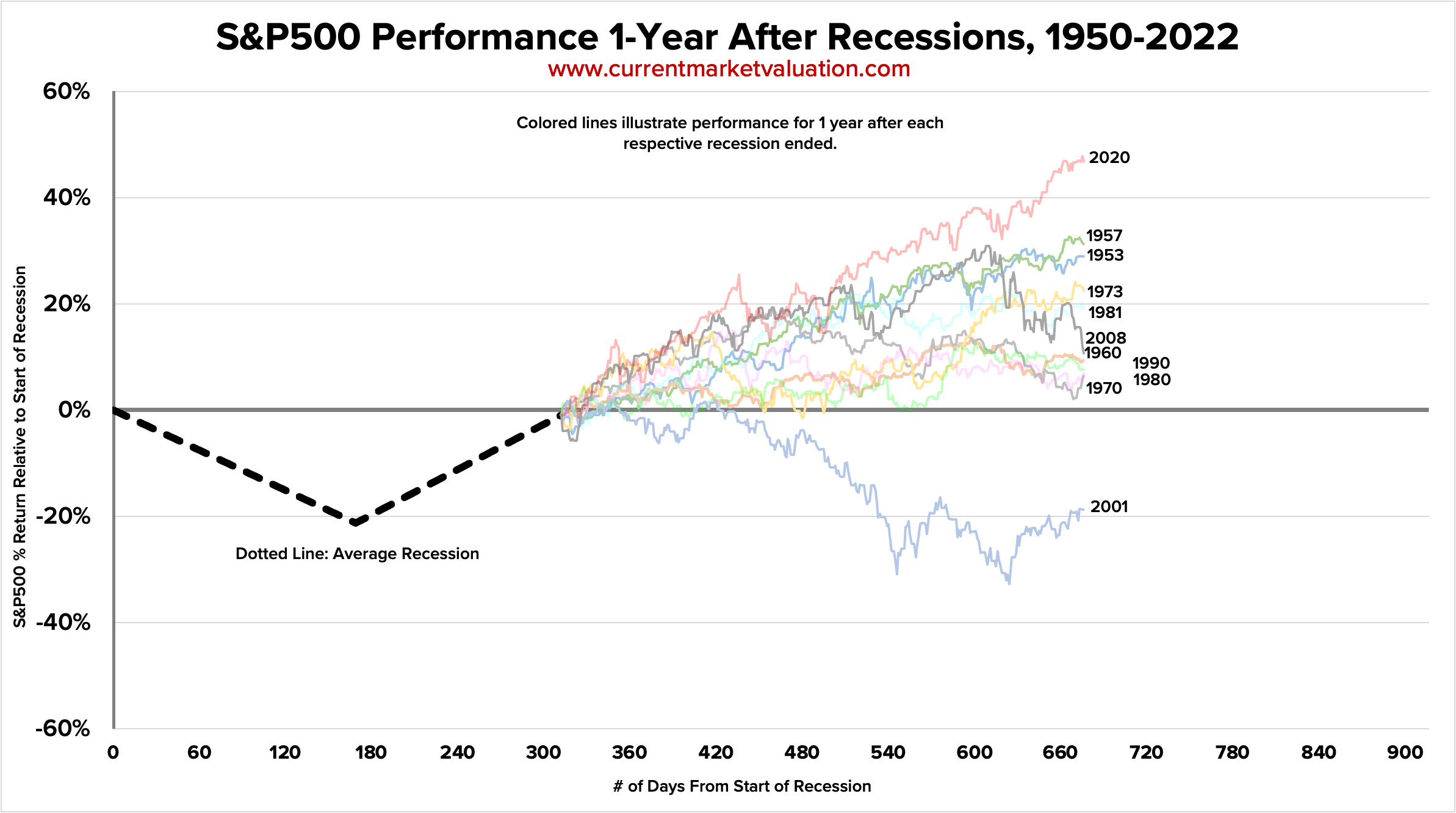

Given NBER's data, the chart below shows S&P500 performance over 11 recessions from the past 70 post-war years. (The chart is copied from the CMV Yield Curve Model and so includes highlighted yield curve inversions, which are irrelevant here).

It's clear from the chart that recessions are at least somewhat correlated with bad stock market performance, but not obvious exactly how. Does the market fall before the recession begins, or during the recession itself? Is the drop off worse given the duration of the recession? How quickly after the recession ends (or even while the recession is ongoing) does the stock market recover?

What a Recession Looks Like

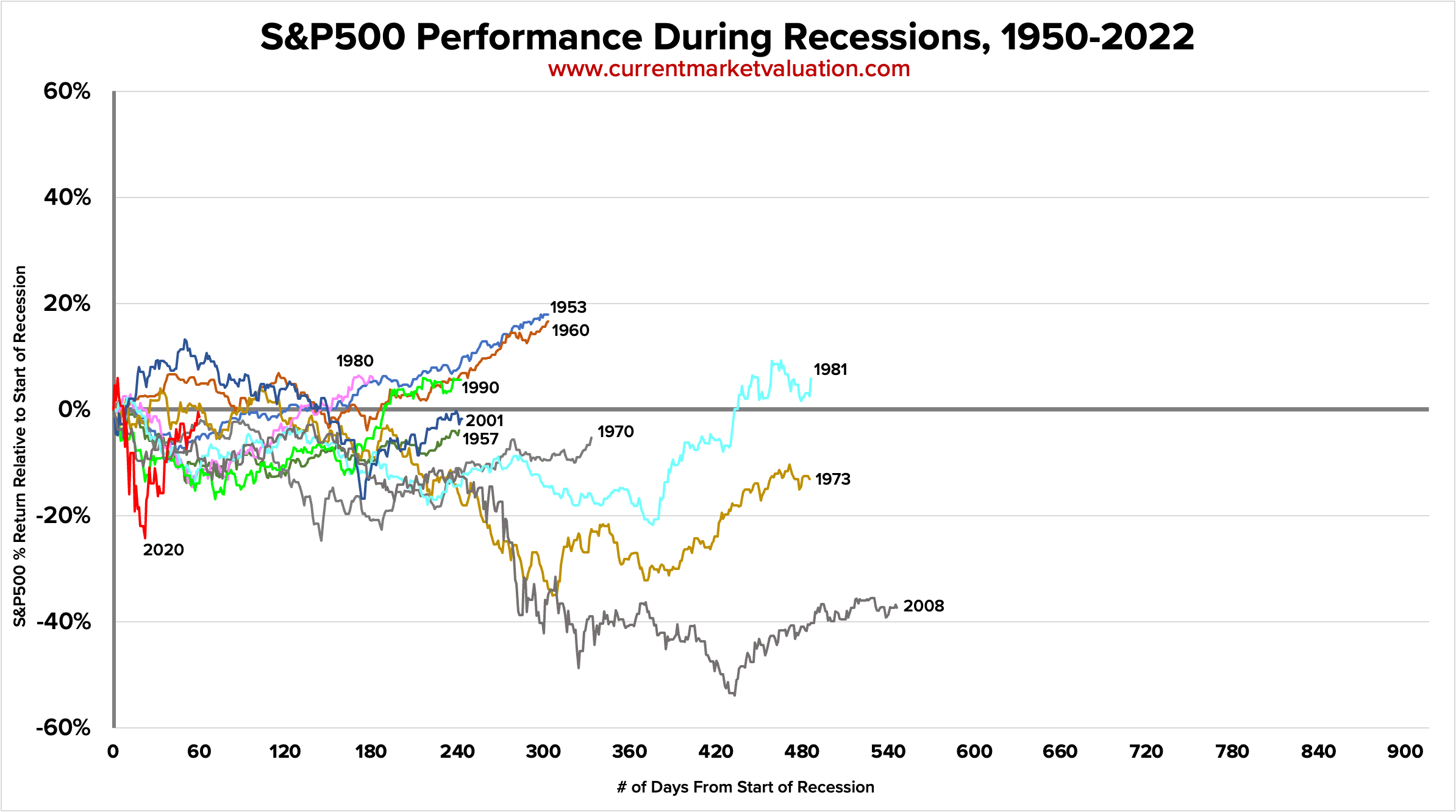

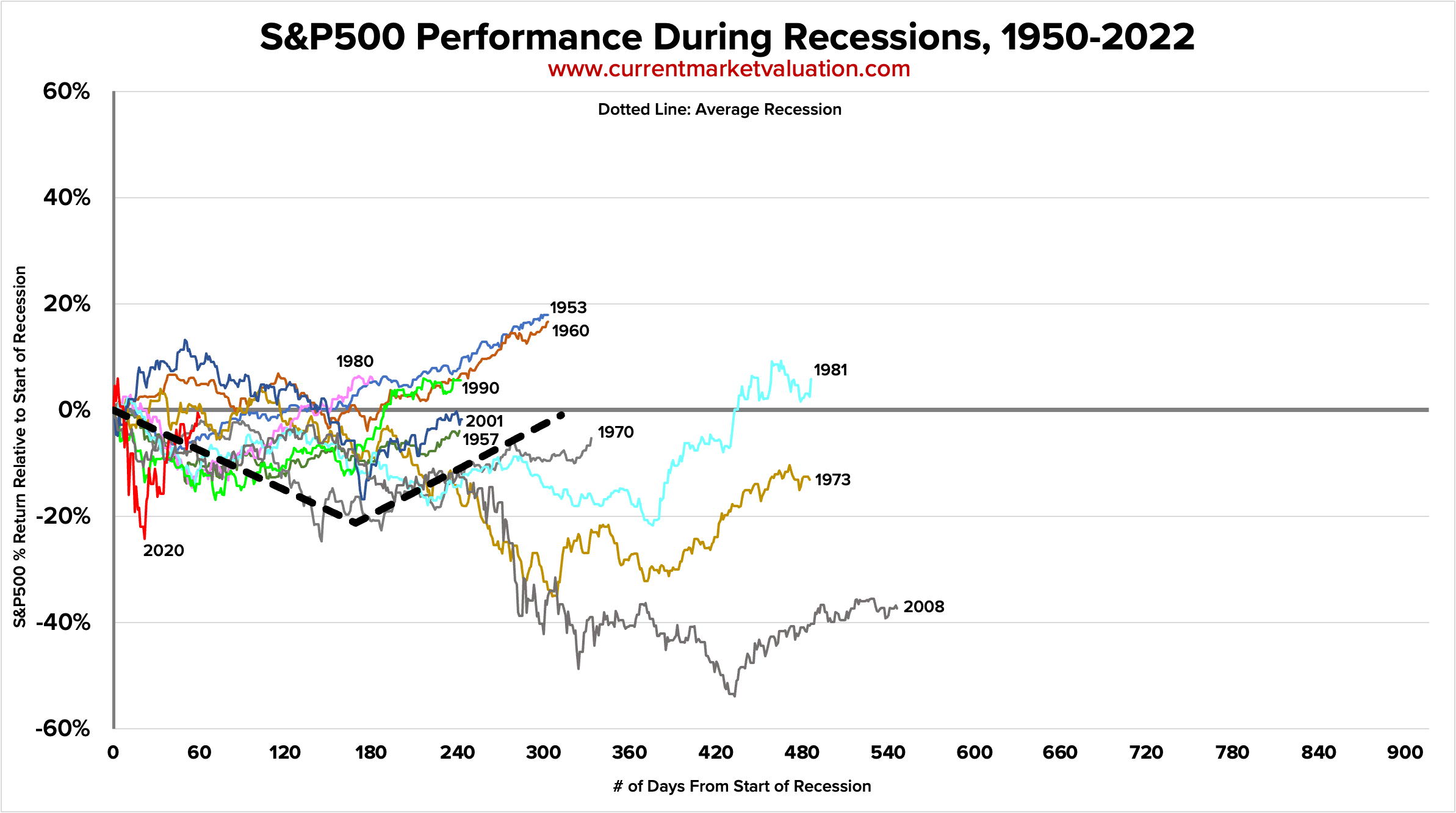

The above chart shows S&P500 stock market performance during each recession over the last 50 years, indexed to 0% on the day that NBER says the recession officially began.

A few things immediately stand out:

- Most recessions last less than one year. In fact, only 3 of the 11 recessions since 1950 went on for more than one year.

- Most recessions have a period of significant stock market drops shortly after the recession begins.

- For every single recession, the stock market is recovering by the time the recession ends. About half the time (5 of 11) the market is back above breakeven by the end of the recession.

- Our most recent 2 recessions have each been outliers in some fashion. The 2008 recession was by far the deepest (worst stock market performance, S&P500 bottomed out at 54% losses) and also the longest at 546 days. The 2020 recession had the steepest immediate sell off, but was also the shortest recession on record at 60 days.

As the chart shows, recessions come side-by-side with stock market losses. Of the 11 recessions since 1950, the average recession ends after 312 days and with the stock market down only 1%. The average market bottom during the recession comes after 169 days with the S&P500 down 21%. These summary statistics are superimposed on the chart, below.

What About After?

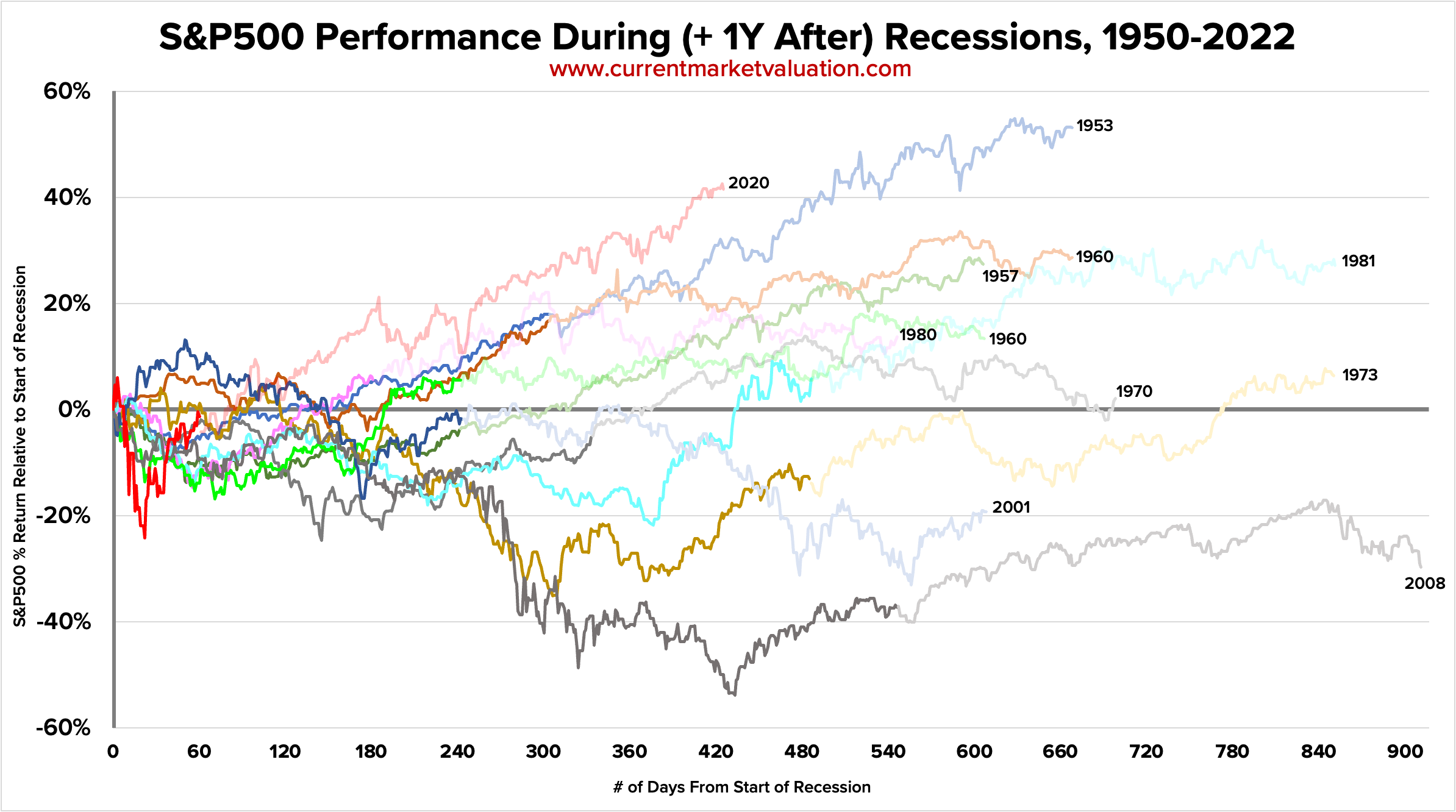

As shown above, by the time the average recession has ended the stock market has fully recovered. What happens next? Do markets tend to over-perform in the period right after a recession? This should be pretty easy to observe over the last 70 years.

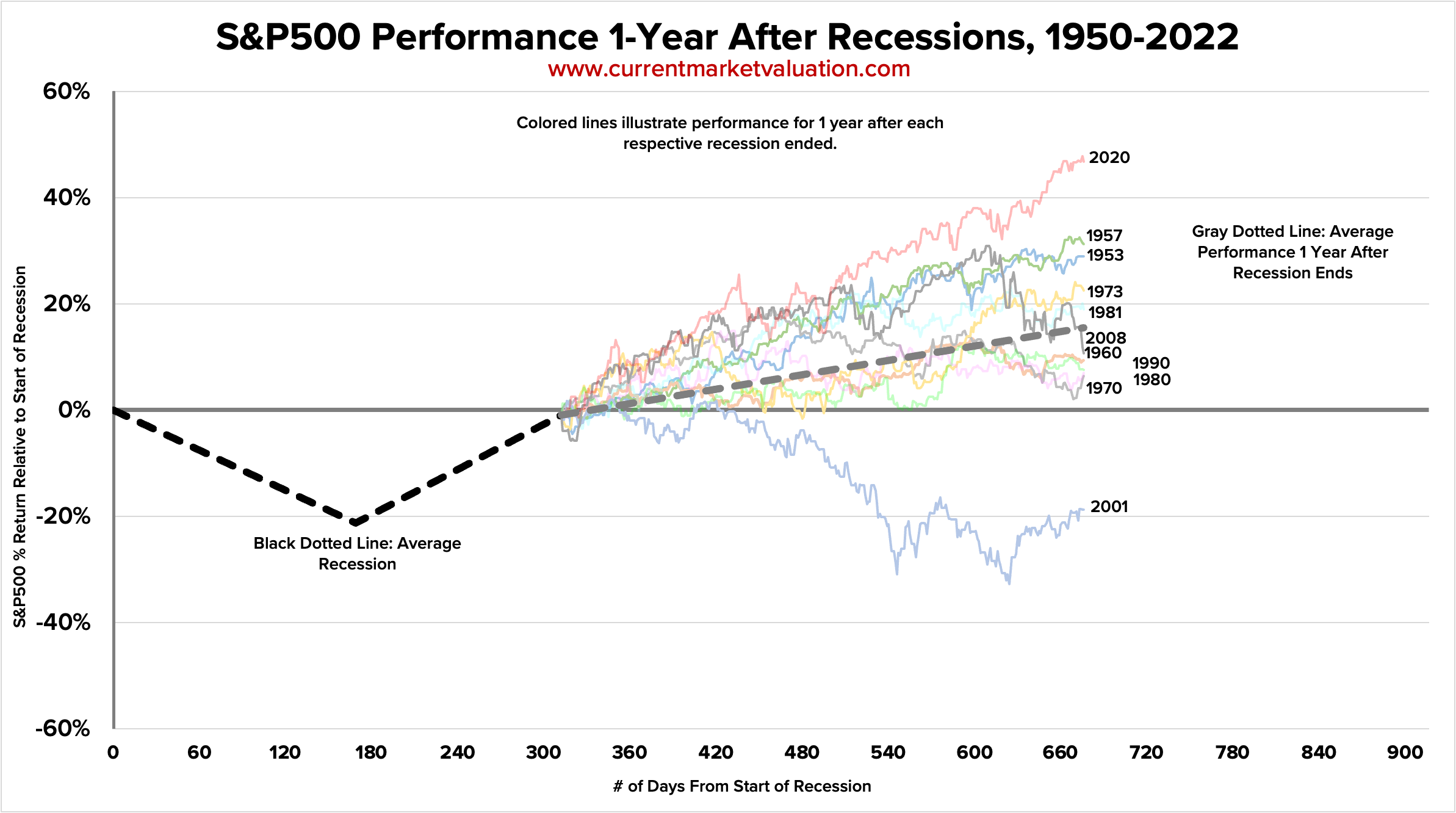

Below is a chart similar to the format used above, showing S&P500 performance for all 11 recessions since 1950, indexed to 0% on the day each recession started. However, this chart shows additional performance for 1 year after each recession ends. This data is a bit hard to visualize - it appears like in most cases the stock market recovery continues for the year after the recession ends, but it's hard to get a good sense of the pattern since each starting point is different.

To better visualize this, the below chart shows the same data, but indexed to begin at the end of the average recession calculated in the section above.

Now it is quite clear that in every recession except 2001, the 1-year period after the recession formally ended produced positive S&P500 returns. In fact, the average S&P500 return in the 1-year period after a recession ended was +15.5%. This is illustrated as another dotted line below.

What Came Before?

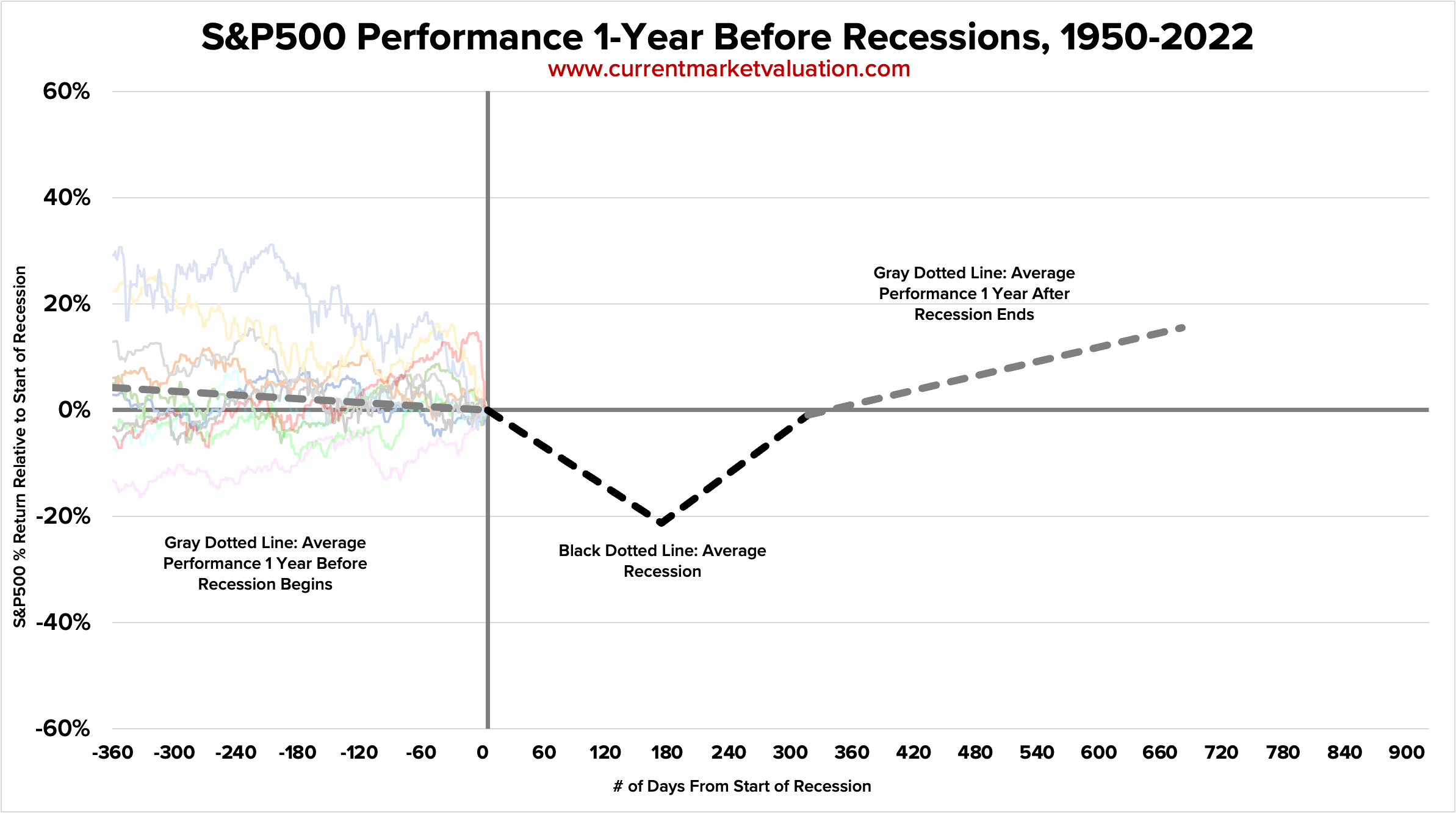

We now have a very clear picture of S&P500 performance during-and-after every recession since 1950. The last reasonable question to ask is whether or not we're looking at the data too late. Recessions are often predicted long before they actually occur, and the stock market should be pricing this in. That is, we should expect that by the time a recession formally beings, the stock market would have already fallen. Let's take a look. Below is another chart in the same style as before, now showing the 1-year period prior to the start of each recession. Once again, returns are indexed to 0% on the day the recession began.

The year before each recession seems pretty well distributed. Once again, graphing the average performance (dotted line) shows that on average the S&P500 falls about 4% in the each prior to each recession.

Conclusion

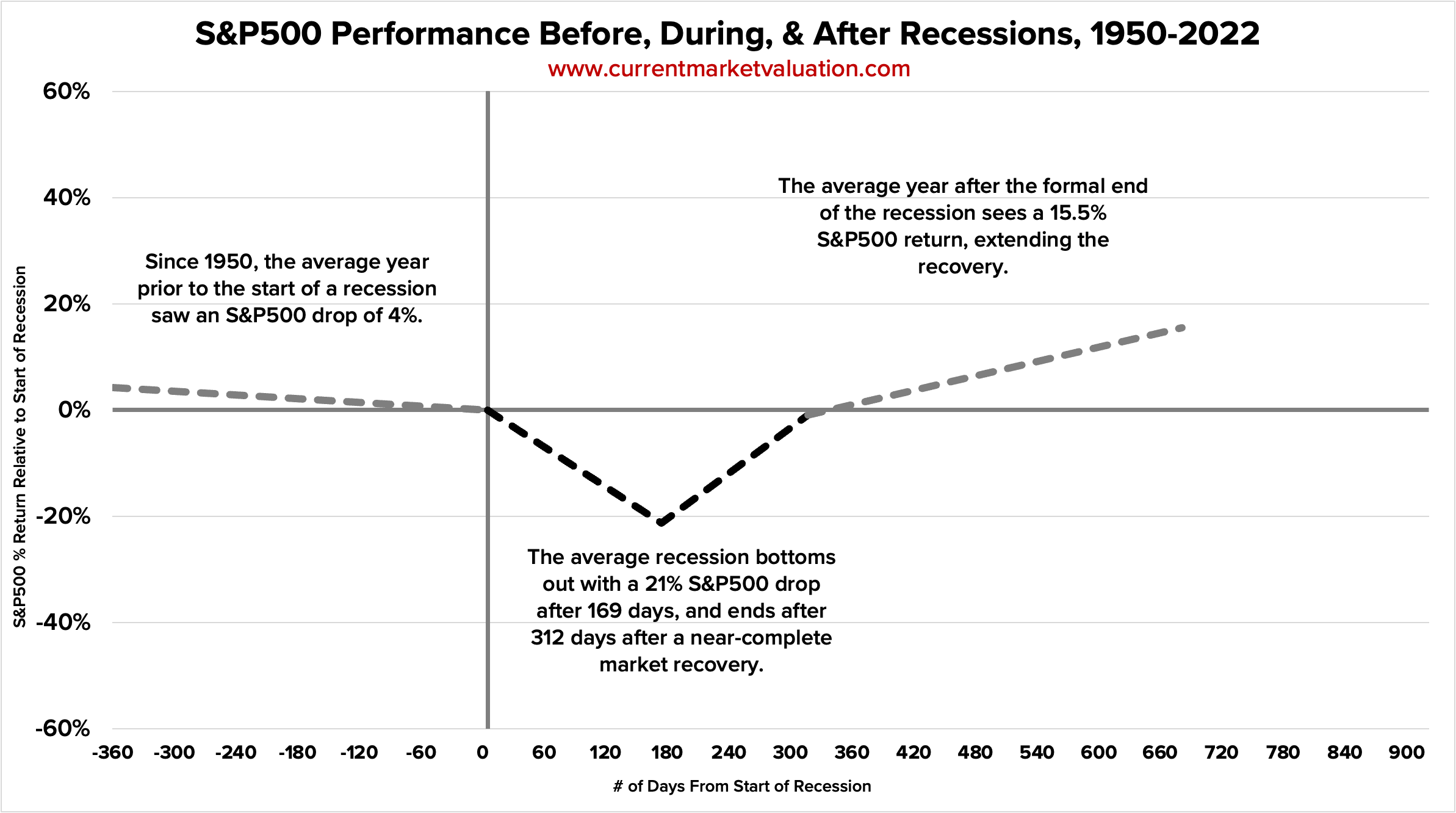

The chart below summarizes all the data thus far:

From here we can draw the following conclusions:

- In the year prior to each recession, the market drops only 4%, with much more downside to come.

- The recession itself sees steep market sell-offs, shedding ~20% of value in less than 6-months.

- Recovery from the market bottom is swift and severe. The average recovery is almost +40% in the ~18months following the market bottom in the midst of the recession.

By and large this would suggest that if you believe a recession is coming in the near future, history suggests you'd be best off by waiting until the recession itself before putting more money in the market. As always though, trying to time the exact market bottom is a fool's game, and by waiting to invest you risk sitting on the sidelines for too long, and missing out on the steep post-trough recovery.

Data Sources

The below table cites all data and sources used in constructing the charts, or otherwise referred to, on this page.

| Item | Source |

|---|---|

| Recession Data | The National Bureau of Economic Research (NBER) |

| SP500 Data | Yahoo! Finance S&P500 Monthly Close Values |