Contact

- [email protected]. Any feedback is appreciated. All emails will be read, though unfortunately not everything can be responded to.

- [email protected] for any press inquiries. Press outlets and/or research analysts or publications may use any quotes or images from the site, given attribution is made (with a hyperlink) to www.currentmarketvaluation.com.

Philosophy

Current Market Valuation (CMV) is a resource to objectively track long-term indicators of stock market valuation and economic strength. This site aims to be an educational resource on market cycles and fundamentals - not a stock trading strategy or timing system.

Research has consistently shown for decades that the best investment strategy is long term buy-and-hold, and that the more active trading retail investors do, the worse they perform. CMV makes judgements about whether or not the market is under or over valued relative to historic norms, but those ratings are not necessarily predictive of future rallies or crashes. Valuation models like this can be wrong for a very long time.

CMV strives to be as transparent as possible in data and methodology. Nothing on this site is either complex or proprietary. Most data are publicly available from free sources, and always cited.

Our Perspective

1) Day Trading Doesn't Work

The various studies and data outlining the extent to which day trading is an unwise decision are outlined here. Suffice it to say, day trading is a money-losing proposition. Anyone who claims otherwise is probably trying to sell you a course. It should be treated the same as sports betting: as an entertainment expense that you expect to lose.

2) Stock Picking Doesn't Work

Even if you're committed to buying good companies and holding them for the long term, picking individual stocks is usually not going to pan out. No matter how smart you think you are, it's incredibly unlikely that you'll be able to outperform the broad stock market.

Even professional mutual fund managers who spend their entire careers doing this exact job still don't reliably outperform the market. It's statistically very improbable that you'll end up picking an outperforming company, and if you do, it's even less likely you'll have the behavioral discipline to sell it at the right time.

3) Invest in Broad Market ETFs

This is the most boring answer, but long-term investing in broad, passively-managed ETFs that track the overall stock market is the more reliable way to earn a return. These have extremely low fees, high liquidity, and consistently outperform professional fund managers. That said, depending on your specific needs (liquidity requirements, tax considerations, etc), ETFs may not be right for you. This isn't financial advice, and you should consult with an advisor before making financial decisions.

For those who are seeking additional investment advice, Reddit's r/personalfinance community is a great place to start. Their wiki on general personal finance is helpful, specifically the subsection on general investment advice.

Our Ratings

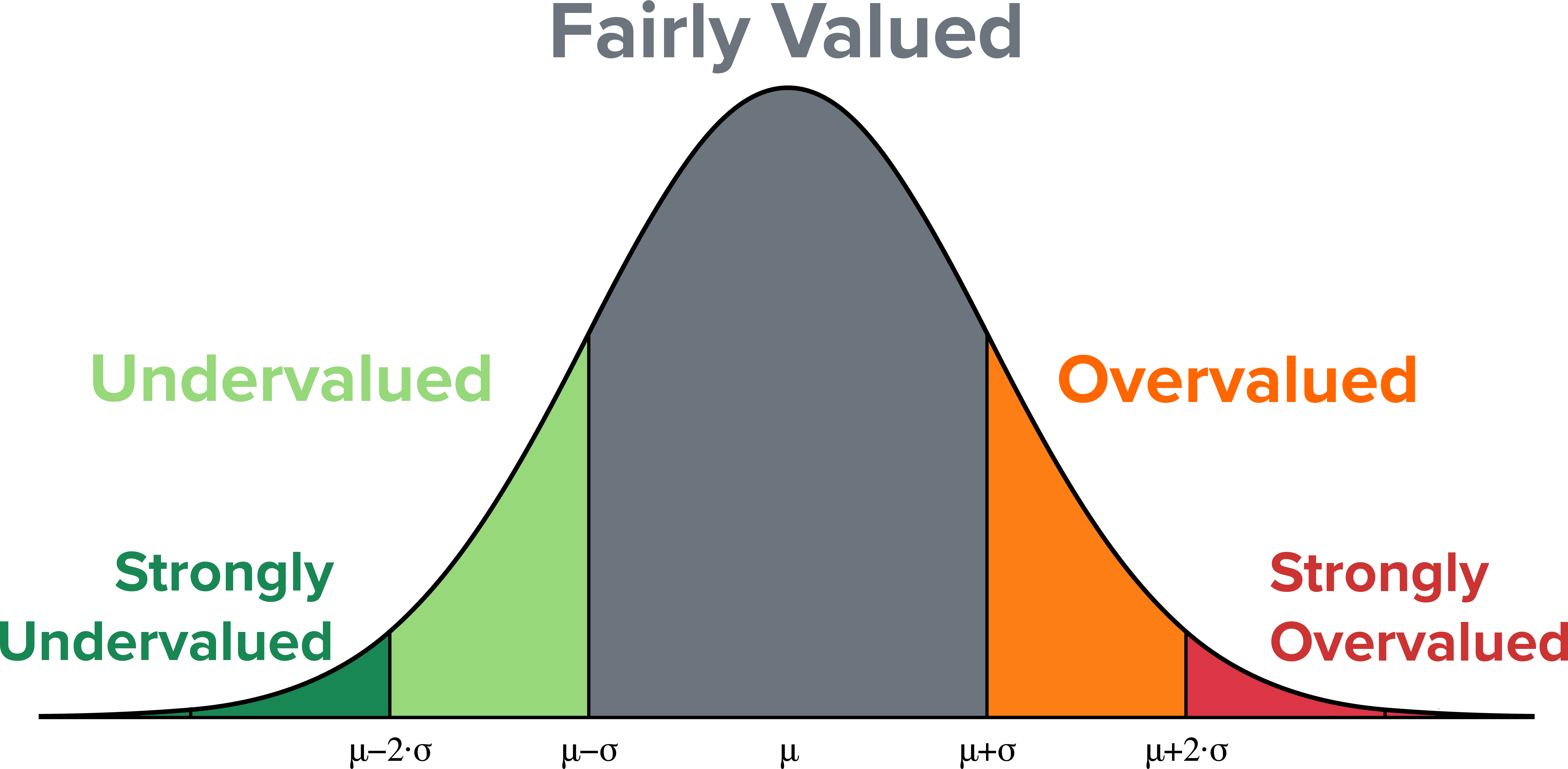

CMV tracks several long term macroeconomic indicators, comparing current values to their historical norms. The methodology is explained in each model's individual page, but generally each model looks for the over/undervaluation of the respective indicator in terms of how many standard deviations the current value is from the historical norm.

Our market ratings are:

Valuation Indicators

Strongly Undervalued This rating corresponds to values less than -2 standard deviations from the mean, and should statistically occur about 2% of the time.

Undervalued This rating corresponds to values between -1 and -2 standard deviations from the mean, and should statistically occur about 14% of the time.

Fairly Valued This is by far the largest rank, corresponding to values between -1 and 1 standard deviation from the mean. Our models should be ranked as Fairly Valued about 70% of the time. Depending if the value is greater than / less than zero, we may present this a 'slightly over/undervalued'.

Overvalued This rating corresponds to values between 1 and 2 standard deviations from the mean, and should statistically occur about 14% of the time.

Strongly Overvalued This rating corresponds to values greater than 2 standard deviations from the mean, and should statistically occur about 2% of the time.

Note that our other model categories (recession indicators, market sentiment) use the identical +/- standard deviation methodology as above, though these are assigned different terminology since those models do not track valuation. Those ratings are:

Recession Indicators

Very Low, Low, Normal, High, Very High.

These model ratings reflect the relative likelihood of a recession. Note that these models may differ on the expected timing. For example, the Yield Curve Model is an indicator of recession likelihood within the next 0-18 months, whereas the Sahm Rule indicator reflects the likelihood that we are currently in a recession.

Market Sentiment

Very Pessimistic, Pessimistic, Neutral, Optimistic, Very Optimistic.

Note that this one is a bit counterintuitive. As Warren Buffett said: "be fearful when others are greedy ... and greedy only when others are fearful". In that sense we view signs of market optimism as an indicator that things may be a little frothy, and signs of market pessimism as potential buying opportunities for long term investors. That said, these models in particular need to be understood in a larger context, as they may leading indicators of better/worse times ahead.

Press

Selected press clippings featuring CMV are below.

- The Guardian: Citigroup credited client’s account with $81tn before error spotted

- Bloomberg: Warren Buffett’s Favorite Valuation Metric Is Ringing an Alarm

- Yahoo Finance: Warren Buffett's favorite stock market indicator reaches internet bubble extreme

- Yahoo Finance: Will September be Bear or Bull?

- Forbes: This Isn’t Your Father’s Overvalued Market

- Forbes: How Life Settlements Can Offer Returns and Diversification

- Forbes: Investing in a Brave New World

- Business Insider: Contrarian Investments According to Fidelity Strategy Director

- The Motley Fool: This Warren Buffett Indicator Is a Red Flag. Should Investors Worry?

Disclaimer on Financial Advice

The information provided on www.currentmarketvaluation.com ("CMV") is for informational purposes only. It should not be considered legal or financial advice. You should consult with an attorney or other professional to determine what may be best for your individual needs.

CMV does not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. We are not a registered investment advisor, broker/dealer, securities broker, or financial planner. To the maximum extent permitted by law, CMV disclaims any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

Content contained on or made available through the website is not intended to and does not constitute legal advice or investment advice and no attorney-client relationship is formed. Your use of the information on the website or materials linked from the Web is at your own risk.

The valuation models that are explored on this site are very long term focused. The trends analyzed and illustrated here play out over years, or even decades. When we say that the market is "overvalued", that is in reference to historical norms only, not a prediction of future results.

Please, please, please do not use CMV to try to time the market. Day trading and/or market timing is a fantastic way to lose money.

Privacy Policy

Effective and last updated February 22, 2024.

The CMV website itself does not directly monitor, collect, or store personal user data on our own servers. However, we use third-party services (Google Analytics, Mailchimp, MemberSpace, Stripe) that may collect and store certain data as described below.

Google Analytics

We use Google Analytics to analyze the use of our website. Google Analytics gathers information about website use by means of cookies. The information gathered relating to our website is used to create reports about the traffic and usage patterns on our website. This information is collected and stored by Google. Google's privacy policy is available at: https://www.google.com/policies/privacy/.

Mailchimp

We use Mailchimp to administer our newsletter. User emails are maintained and stored by Mailchimp. Their privacy policies are available here

.MemberSpace & Stripe

We take your security seriously. We use MemberSpace to administer our paid membership program. As part of the member signup process, personalized information (name, email, payment info, etc) is provided by users to MemberSpace, which processes payments via Stripe, a certified PCI Service Provider Level 1 — the most stringent level of certification available in the payments industry. All payment transactions are processed over HTTPS using TLS encryption. This information is hosted, stored, and secured by those respective services.

When you make a purchase on our website, your payment information is transmitted securely and is never stored on our servers. We partner with Stripe so that your data is handled with the highest standards of security and compliance. More information on those standards can be found here.